Perfect Is the Enemy of Good Enough (Especially When Your VP Needs Answers by Monday)

A framework for knowing when 4 hours of analysis beats 4 days

Last week, I saw a post with a six-step framework for investigating metric drops. It was excellent and very thorough. The kind of systematic approach that would make any data scientist proud.

But here’s what was missing: what to do when you don’t have time for all six steps. Because in the real world, you almost never do.

Leadership wanted answers yesterday and you’re still investigating why conversion dropped today. Or you’re debugging a metrics spike while also shipping a feature, running a hiring process, and putting out three other fires.

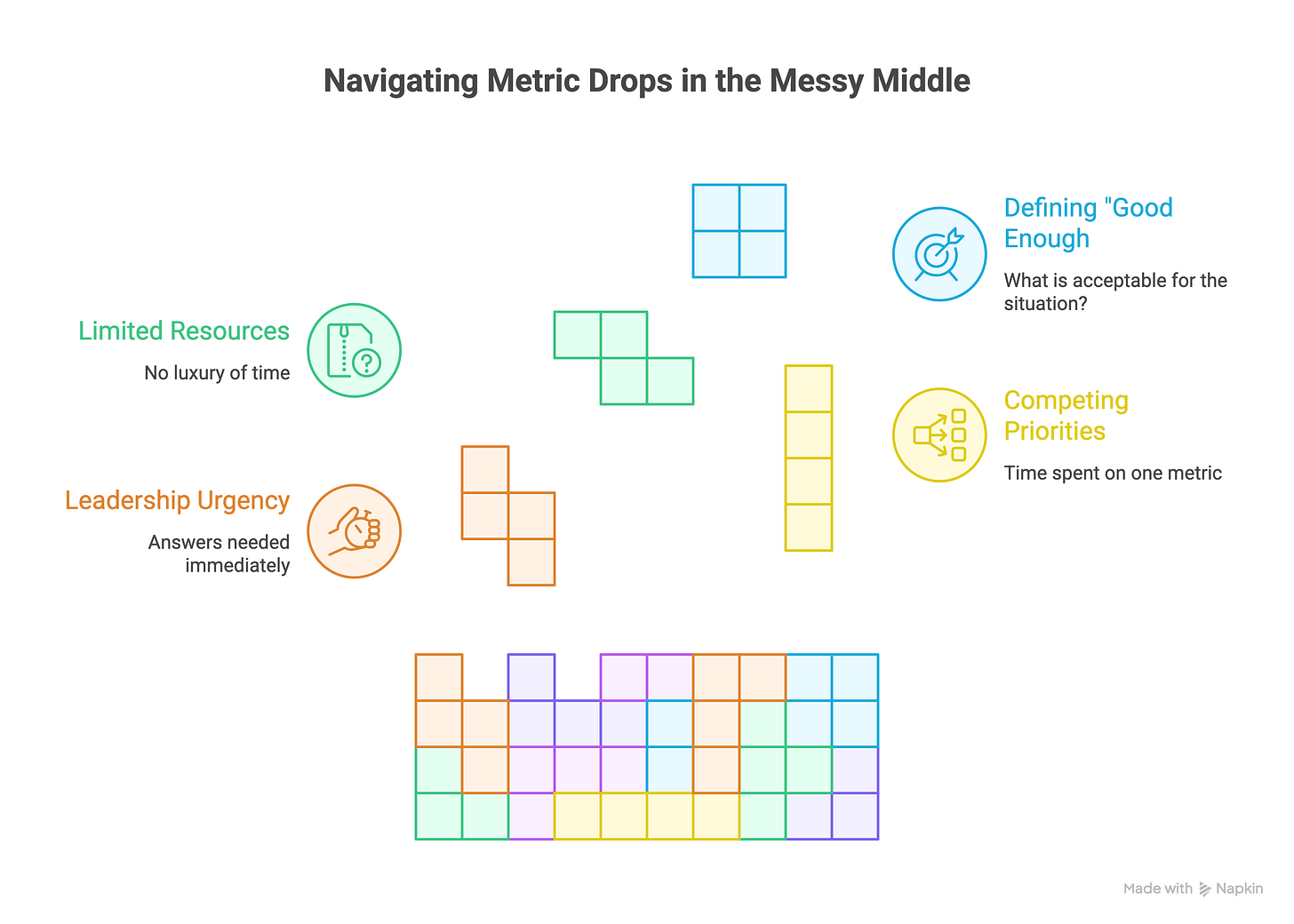

The frameworks everyone shares assume you have the luxury of time and resources to “get it right.” But most product leaders work in what I call the messy middle. You don’t have unlimited resources. You have competing priorities. Every hour you spend investigating one metric is an hour you’re not spending on something else that also matters.

So the question isn’t just “how do I investigate metrics?”, it actually is “what does good enough look like for THIS situation?”

The Trap of “Complete Analysis”

Most product leaders I work with fall into the same trap. They think incomplete analysis risks making them looking incompetent.

They’ve been trained as individual contributors to be thorough, to cross all t’s and dot all i’s. That instinct served them well when they were PMs building features. But as they move into leadership roles, that same instinct becomes a liability.

Because here’s what actually tanks their credibility: spending three days to get to 95% confidence when your exec team needed to make a decision two days ago with 70% confidence.

The skill that separates good product leaders from great ones isn’t just knowing how to investigate deeply. It’s possessing the judgment to know what level of investigation is appropriate for each situation.

What Leadership Actually Needs

When your VP asks for answers by Monday, they’re almost never asking for 100% certainty.

They’re asking for your best thinking with the time and information you have.

What they actually need:

Confirmation the metric change is real (not a data issue or seasonality)

Your top 2-3 hypotheses about what happened

Which hypothesis seems most likely and why

What you’re doing next to confirm

When you’ll have more certainty

Notice what’s NOT on that list: a complete root cause analysis with every edge case investigated.

This is 4-6 hours of work, not 3-4 days.

A Story About Getting It Wrong

Friday, 4:30 PM. A Director I advise discovered revenue had dropped 8% that week.

Her VP’s response to the status update: “I need answers before I walk into Monday’s exec meeting. What happened and what are we doing about it?”

My phone at 8 PM: “This is impossible. My VP wants me to work all weekend and I STILL won’t have time to finish the analysis properly. I’ve given him wrong answers before and it’s affected my credibility already. But if I don’t give him something before he walks into his meeting Monday morning, I will look totally incompetent. How do I win?”

I could hear the panic in her message. She was trapped between two fears: looking incompetent for sharing an incomplete analysis and potentially an incorrect recommendation, or looking incompetent for having nothing to say.

But she was asking the wrong question.

The question should not have been “How do I finish the analysis by Monday?”

It should have been “What does my VP actually need to walk into that room with?”

The 4-Hour Version

Here's the framework I gave her:

30 minutes: Confirm the drop is real

Check for data issues (logging problems, definition changes)

Compare to the same week every quarter in the last year, not just last week (matching the revenue cadence for her product)

Check if it’s across all segments or specific to one segment

1 hour: List possible drivers

Don’t analyze yet, just brainstorm

Get to 5-7 possibilities

Think about what changed across different functional areas that may have had an impact: engineering, product, marketing, sales, operations in her case

2 hours: Do a quick analysis on top 3

Not exhaustive, just directional

Enough to say “this seems likely” or “this seems unlikely”

Use existing dashboards and queries, don’t build new infrastructure

If the data is not easily accessible, consider how existing data can be used to rule out options at a minimum

45 minutes: Write it up

Here’s what we know (the drop is real, here’s the scope)

Here’s what we think (top hypothesis with directional evidence)

Here’s what we’re doing next (specific investigation plan)

Here’s when we’ll know more (timeline)

Then stop. You’re done.

Monday morning, she walked into her VP’s office with exactly what was needed. The VP walked into the exec meeting with a clear point of view and a plan.

Her top hypothesis was not right, but her second pick was. But even if it wasn’t, she’d given leadership what they actually needed: enough information to make decisions and a clear path to more certainty.

The Pattern I See Repeatedly

I see this happen regularly with product leaders who are moving from IC roles into Director+ positions. As ICs, they were rewarded for thoroughness, for finding the edge cases and for being right. It was important to have all the answers before they spoke up.

As leaders, those same instincts hold them back. They spend too long investigating. They wait to share findings until they’re certain. Terse updates or routine non-updates become a trust/credibility issue where the leadership default is no progress update is bad news. They miss the window when leadership actually needs the information.

The mindset shift they need: Strategic leadership isn’t about having perfect information. It’s about knowing what level of confidence is appropriate for each decision, and how to communicate uncertainty without losing credibility.

When to Do the Full Investigation

Some situations deserve the full treatment.

Do a complete investigation when:

You’re making an irreversible decision based on the findings

There’s regulatory or legal implications

You have evidence of a systemic problem, not just a one-time blip

You have time before anyone needs to make a decision

But most metric drops don’t fit these criteria.

Most of the time, you’re dealing with:

Week-over-week fluctuations that need monitoring

Decisions that can be adjusted if you learn more later

Situations where waiting three days for certainty costs more than acting on 70% confidence

Questions from leadership who need enough information to prioritize, not perfect information to commit

The Critical Question

Before you start investigating, ask yourself: “What does good enough look like for THIS situation?”

Not what does perfect look like. Not what would you do if you had unlimited time. What does good enough look like given the time you have and the decision that needs to be made?

That question forces you to think strategically about your investigation, not just execute a process.

It forces you to ask:

Who needs this information and when?

What decision are they trying to make?

What level of confidence do they need?

What’s the cost of waiting for more certainty?

What’s the cost of being wrong?

These are the explicit questions that surface the most important considerations that should inform your strategy and approach.

How to Communicate Incomplete Findings

When the findings are incomplete, it’s more critical than ever to communicate what you have learned so far effectively. You don’t lose credibility by admitting uncertainty. You lose credibility by pretending to be certain when you’re not.

Here is how to do this:

Be clear about what you know: Lead with “We confirmed the drop is real. It’s not a data issue. It’s across all segments, not isolated to one area.”

Be clear about what you think: “Based on the analysis so far, it appears the drop correlates with the pricing change we made two weeks ago. We see a 15% decrease in trial-to-paid conversion since then.”

Be clear about what you don’t know yet: “We haven’t ruled out seasonality or the impact of the marketing campaign that also launched. We’re investigating those next.”

Be clear about what you’re doing: “By Wednesday, we’ll have the segmented analysis that shows if it’s the pricing change or something else. If it’s pricing, I’ll have a recommendation on whether to revert or adjust.”

Be clear about the trade-off: “We could spend another week to be 95% certain, or we could make a call now with 70% confidence. Given that we’re mid-quarter and each week costs us approximately $X in revenue, I recommend we make the call now.”

That’s leadership. That’s strategic communication. That’s what actually builds credibility.

What This Looks Like in Practice

After that Friday night conversation, the Director sent me a message on Tuesday: “You were right. My VP didn’t want certainty. He wanted my best thinking. He actually said ‘I trust your judgment on this’ when I walked him through the hypotheses. I’ve been chasing the wrong thing all along.”

She’d been trying to be the smartest person in the room by having all the answers. What her VP actually valued was her judgment about what mattered and what didn’t.

That’s the shift from doing the work to leading the work. From executing frameworks to applying strategic judgment about when frameworks matter.

The Real Skill

The real skill is knowing what good enough looks like for each situation. It lies in being able to communicate uncertainty without losing credibility.

That’s what I call strategic metric investigation. Not just following a process, but applying judgment about what level of process is appropriate given your constraints.

The question is “What does good enough look like for THIS situation, given the time I have, the decision that needs to be made, and the cost of waiting for more certainty?”

Answer that question first. Then choose your investigation approach.

That’s strategic judgment. And it’s what separates good product leaders from great ones.

If you have a question or a topic in mind, drop it here. I often pick questions from my reader mailbag to address via a post.

I help product leaders in resource-constrained environments develop pattern recognition, strategic communication, and judgment under uncertainty. If this resonates, you can find more at productunblocked.com.